Are You Looking to Start or Grow Your Small Business?

It’s Time to Get to Know Your Small Business Development Center Network

See why you should connect or reconnect with your regional SBDC if you need assistance with your local business.

Specialists In Small Business – San Diego & Imperial SBDC

Our SBDC advisors throughout San Diego and Imperial counties are proven experts in their fields and dedicated to helping entrepreneurs succeed.

From 2018-2023, the San Diego & Imperial SBDC team helped strengthen our regional small businesses.

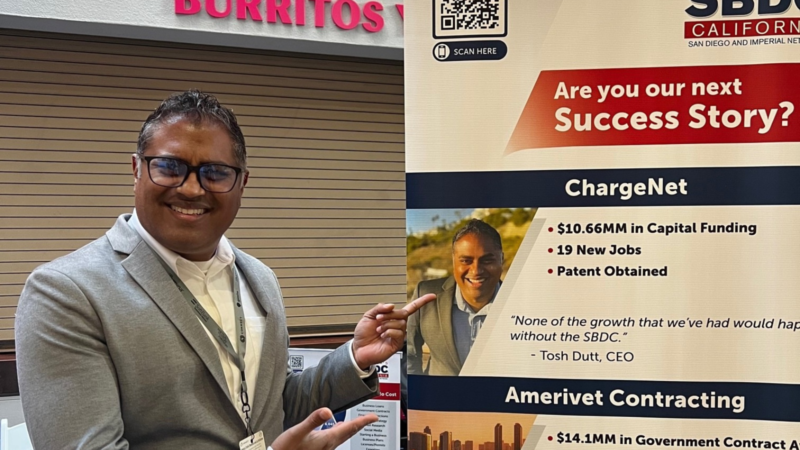

Success Stories

Our clients are why we do what we do. Their stories are what fuel our local economies throughout San Diego and Imperial counties as well as across California and the nation.

Host Locations

SBDC locations are hosted by local nonprofits and academic institutions which provide the infrastructure, staffing, resources, and tools necessary to carry out our mission of serving the region’s small business owners.

Our Clients Say

“The SBDC’s ongoing support has been nothing short of life-saving! Just a phone call away – they give me the courage to pursue my dreams, knowing there is nothing I can’t do with this incredible team on my side.”

“The Brink SBDC is providing an invaluable service to entrepreneurs by giving guidance and providing connections to both investors and customers. Events such as the San Diego Angel Conference are the icing on the cake, which spreads the spirit of entrepreneurship in the community by bringing entrepreneurs and new investors together – and resulted in an investment of over $100,000 for our company.”

“We moved our company to San Diego from Minnesota, and the SBDC gave us instant access to a huge network of contacts that led to obtaining our startup capital and making other crucial connections. Being the “new guy in town” is never easy, but with their help, we hit the ground running.”

“The Brink SBDC and Dr. Martin Kleckner have been invaluable in the success and progress of AccuDava. They dedicated many hours to reviewing and giving advice on our SBIR grant application to the National Cancer Institute, which was successfully awarded $300,000. Their unconditional support continued with extreme efforts that helped us with a $50,000 NIH I-corps grant, which resulted in additional NCI grant funding of $150,000 to extend our diagnostic test application to non-small cell lung cancer.”

In The News

Want to know what SBDC clients and teams have been up to? Take a look at these stories about entrepreneurs, partnering organizations, and other business topics featured in San Diego and Imperial counties’ news.

Connect Takeover of Petco Park with Innovation Day 2023

The San Diego Innovation Sector is taking over Petco Park on September 14th. Innovation Day 2023 is the perfect opportunity to experience cutting-edge

EDA Awards $1.5M to Local Small Business Support Programs

Three-Year Grant to Foster Business Innovation in Areas Historically Underserved | SAN DIEGO (Oct. 31, 2022) – The U.S. Economic Development Administration has awarded a

Regional SBDC State Star Shines in East County

Small Business Development Center Network recognizes exemplary service for entrepreneurs | SAN DIEGO (Aug. 31, 2022) – East County Small Business Development Center Director Danielle

Study Released About COVID-19 Impact on Women-Owned Businesses

California Statewide Report Shares Insights About Effects on Women, Especially Women of Color | SAN DIEGO (July 12, 2022) – Collaborating entities at the federal,

National City Barber Shop Celebrating 50th Anniversary with Perseverance, Style

Multi-generational family business ‘proof positive’ a small business can thrive | Highland Barber Shop in National City will celebrate an inspiring 50 years in business

Client Broad Street Dough Co. Named to Yelp’s Top 100 Donut Shops in US

By Sophia Hernandez, 10News and Domenick Candelieri, Fox5 | SAN DIEGO — June 3 was #NationalDonutDay and some of the nation's best donuts are found

Sponsors

We are grateful to the sponsors who have continued to support SBDC programs and entrepreneurs across San Diego and Imperial counties.